Need Free Dispute Letters?

Want to dispute your negative items but not sure how to write a professional dispute letter?

I Got You!

Join 2,000+ Game-Changers Using The Financial ER Today.

"I've got negative items on my credit I want to dispute but I don't know how to write a dispute letter"

Does this sound like you?

It’s time to regain control and work toward fixing your credit quick and stress-free.

How Do Dispute Letters Erase My Bad Credit History?

Under the FCRA (Fair Credit Reporting Act), anything on your credit report must be complete, accurate, and verifiable. If it’s not? It must be corrected or deleted. That’s where dispute letters come in.

Does Sending A Dispute Reset The 7-Year Clock?

Simply put, NO! Disputing does not reset the 7 year clock for reporting. Even If you don't get the account removed

Will This Hurt My Credit Score?

Nope. Disputing an item doesn’t hurt your score. In fact, if the item gets removed, it could help.

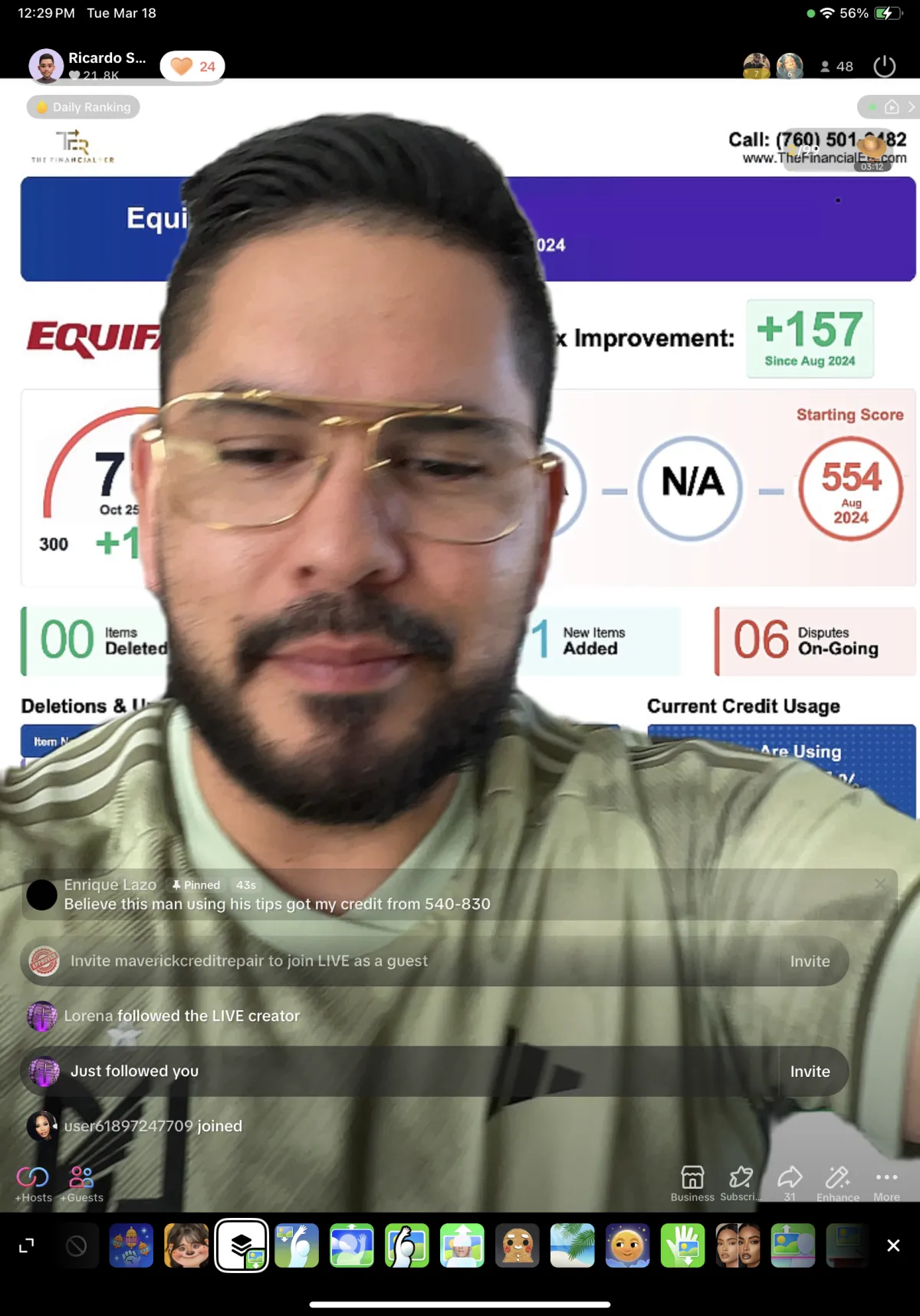

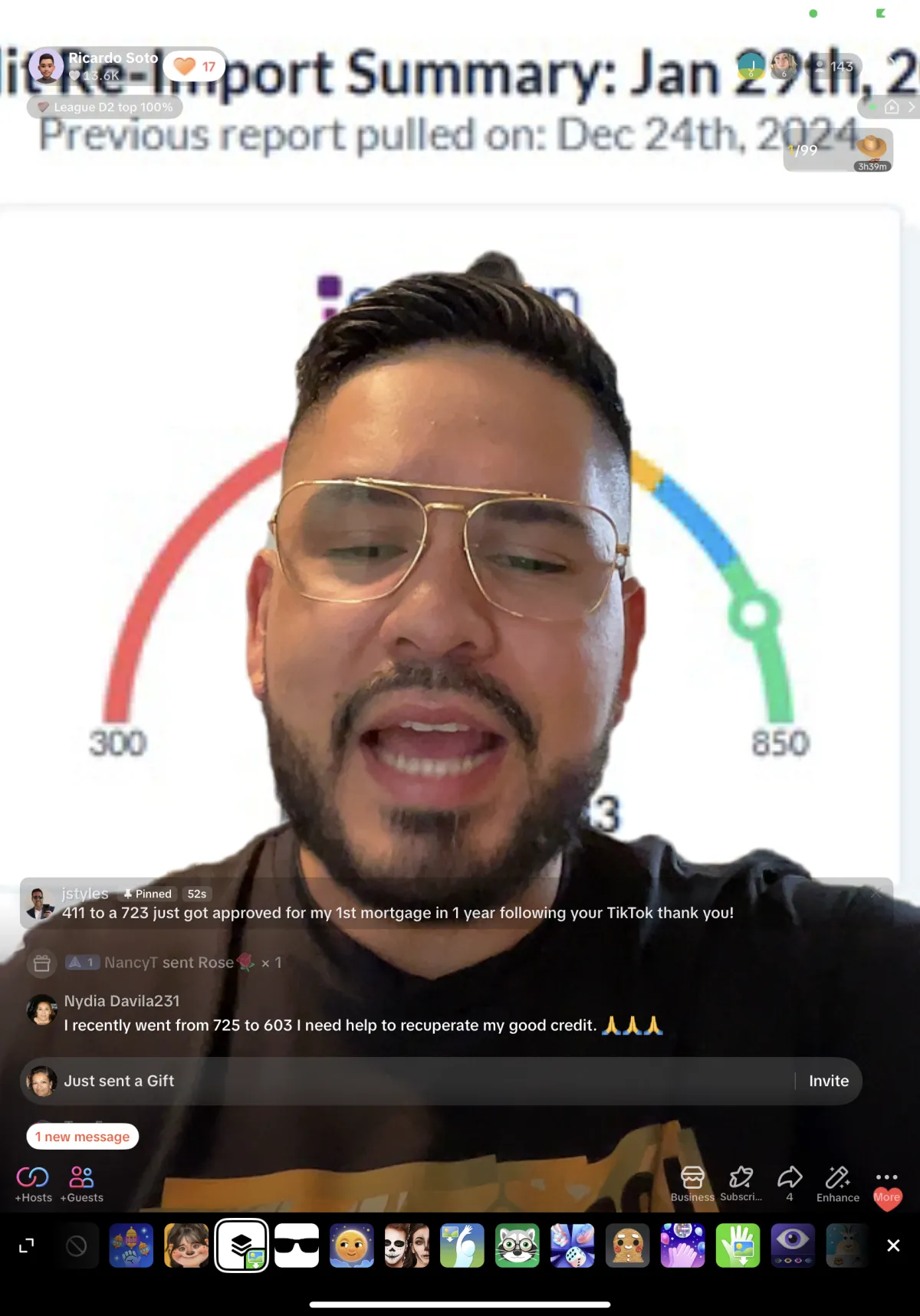

TESTIMONIALS

What People say about us

"Believe this man using his tips got my credit score from 540-830"

"411 to a 723 just got approved for my 1st mortgage in 1 year following your tiktok thank you!"

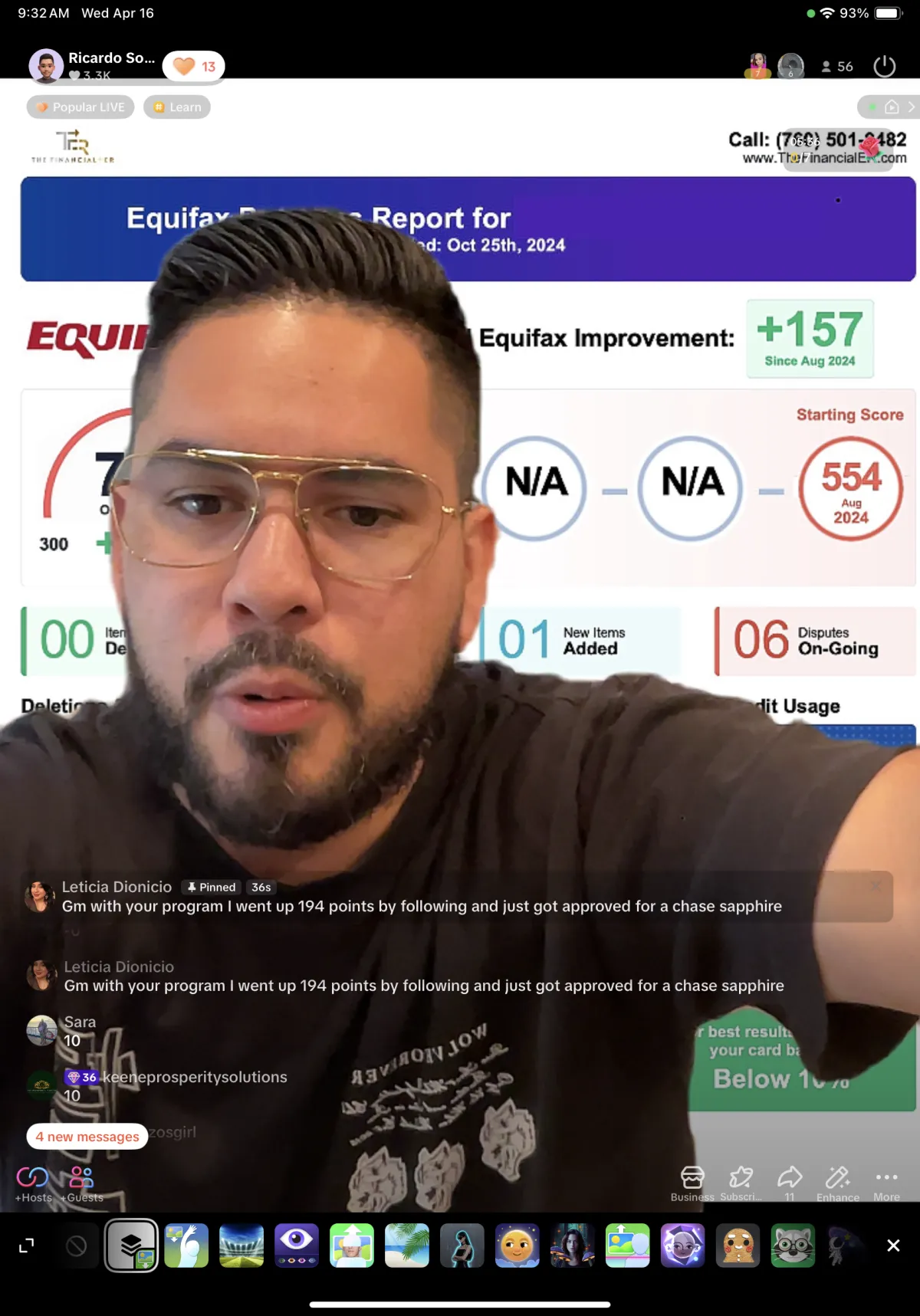

"GM with your program I went up 194 points by following and just got approved for a chase sapphire"

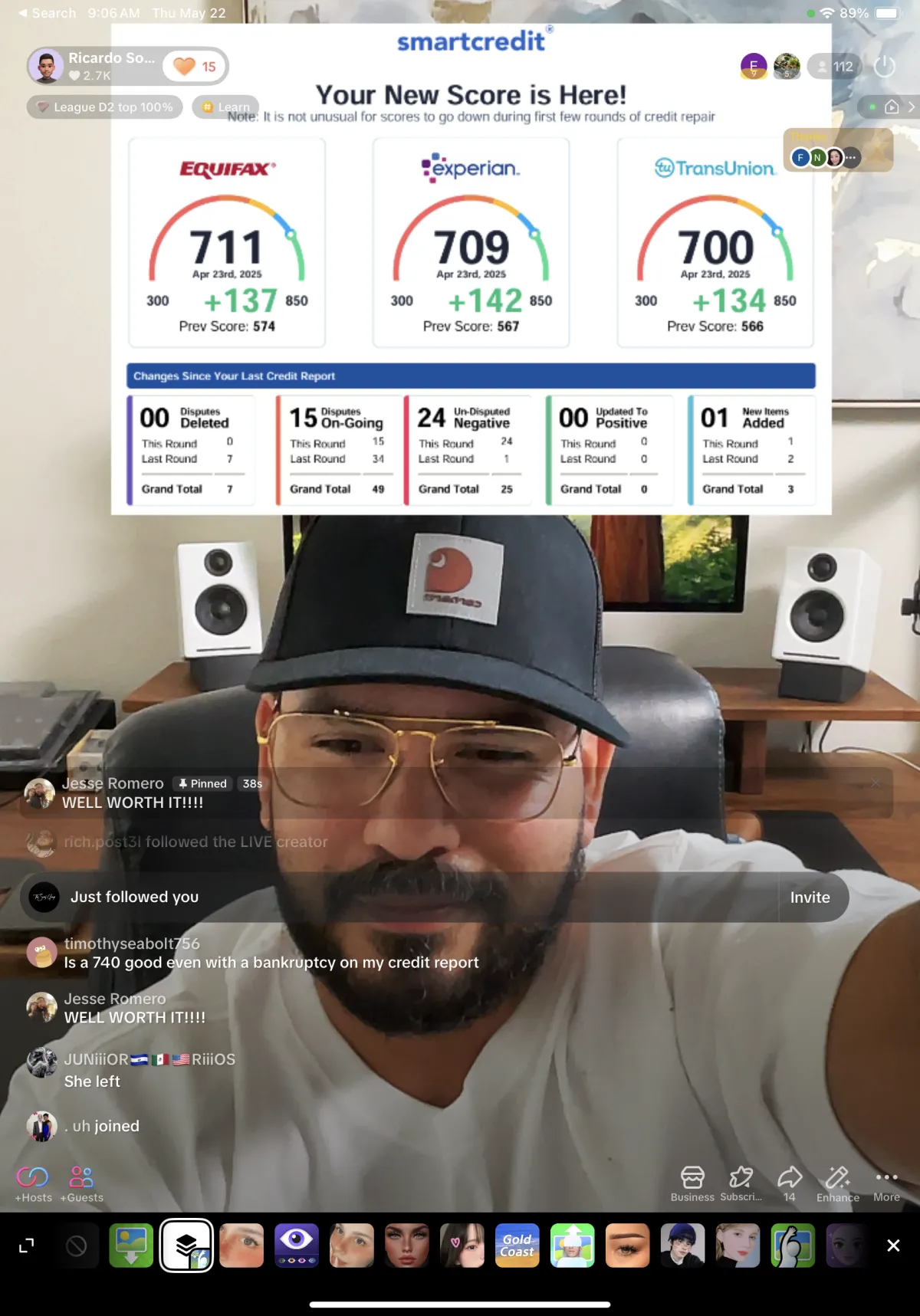

"WELL WORTH IT!!!!"

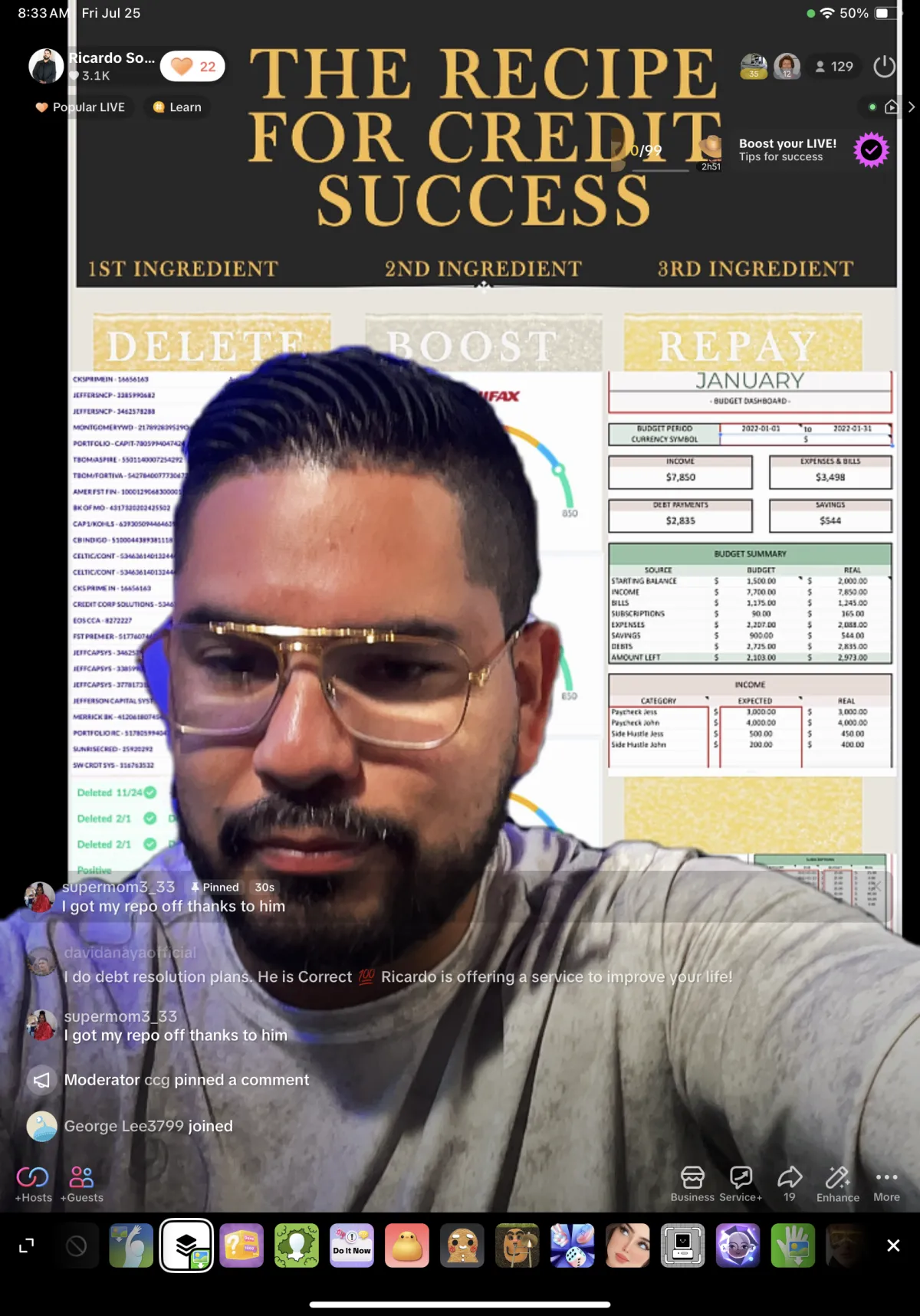

"I got my repo off thanks to him"